Why Birmingham Has Emerged as the No. 1 City in JLL’s Big Six Report – And What That Means for Investors

For years, investors have viewed UK property through a familiar formula: London first, everything else second.

But the 2025 landscape tells a very different story.

According to JLL’s Big Six Residential Development Report – Summer 2025, the UK market is no longer defined by its capital. The centre of gravity has shifted north – and at the heart of that shift sits Birmingham, the unexpected frontrunner and the top-performing city in the report. With annual price growth of 5.6%, Birmingham outpaced every other major regional city. And this isn’t a blip. It’s the product of structural demand, deep regeneration, and a wave of economic activity that investors – both local and overseas – can no longer afford to ignore.

For investors across Hong Kong, Singapore and beyond, the message is simple: If you’re looking at the UK in 2025, you should be looking at Birmingham.

A Market Slowing Down – But Creating Space for the Strongest Cities to Shine

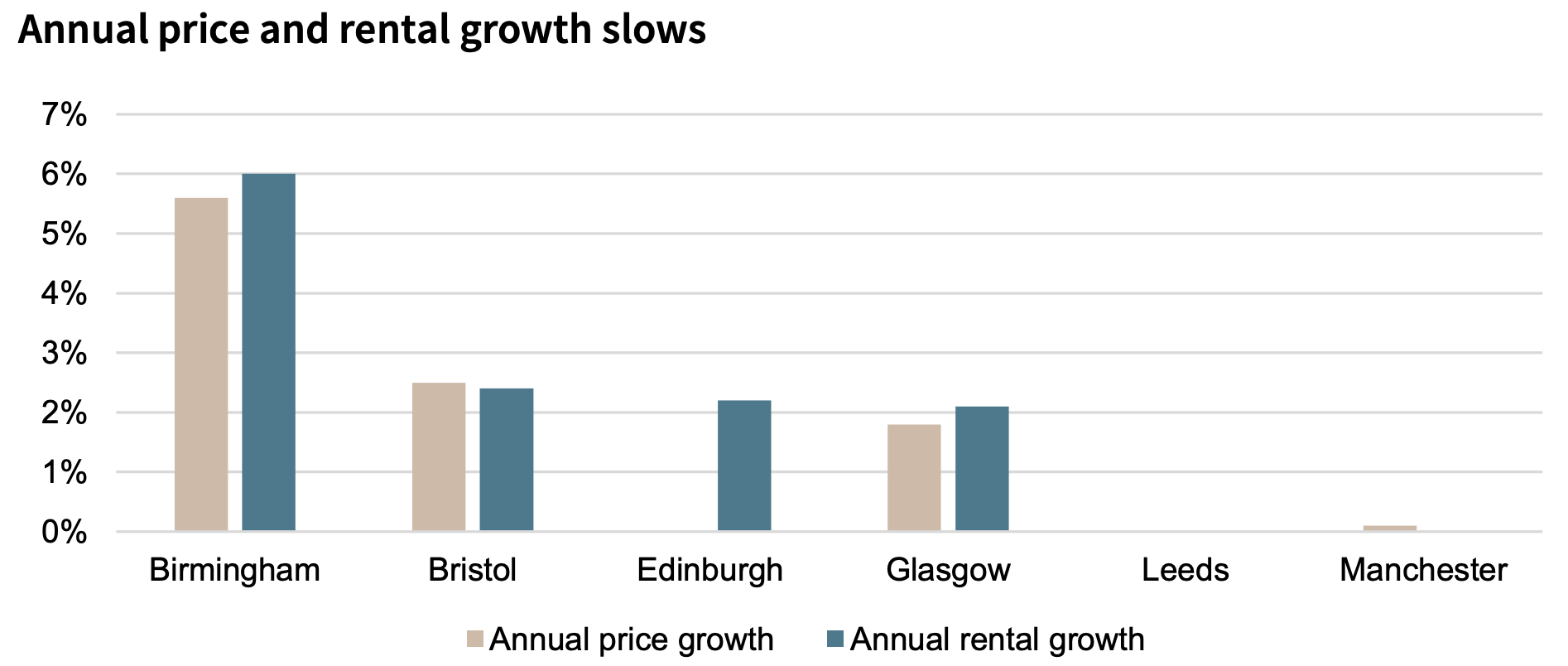

Across the Big Six – Birmingham, Bristol, Edinburgh, Glasgow, Leeds, and Manchester – annual house price growth now sits at 1.7%, with rental growth at 2.1%, both softer than the highs of 2024. Developers are completing fewer homes than at any point in the last decade, while demand continues rising in urban centres.

This slowdown isn’t a crisis; it’s a filter.

In quieter markets, the strongest cities emerge more clearly – those with genuine economic engines, youthful populations, major employers, university ecosystems, and regeneration on a scale that changes skylines.

Birmingham ticks every one of these boxes.

Why Birmingham Stands Apart

JLL calls it out unambiguously: Birmingham posted the strongest annual price growth of the Big Six, rising 5.6% year-on-year.

But the number alone doesn’t tell the story. Here’s what’s driving it:

1. A Regeneration Wave 20 Years in the Making

From HS2-related redevelopment to the £1.9 billion Smithfield project, Birmingham has undergone one of the most ambitious urban transformations outside London. Entire districts have been redesigned, attracting corporate tenants, creative industries, and long-term institutional investment.

2. The Youngest Population of Any Major UK City

Nearly 40% of residents are under 25. That translates into long-term rental demand, a continually renewing workforce, and high absorption rates for new housing.

3. A Corporate and Tech Hub on the Rise

PwC, HSBC UK, Deutsche Bank, Goldman Sachs, and major tech employers have established meaningful presences in Birmingham. This influx of well-paid professionals drives both rental and resale demand.

4. Better Value – Without Compromising Infrastructure

Compared with London, entry prices are significantly lower, but connectivity is high, amenities are strong, and quality-of-life upgrades are ongoing.

For investors, this combination – affordable entry, liquid rental market, modern city infrastructure – is extremely rare.

Patience, Not Speculation – The 2025–2029 Outlook

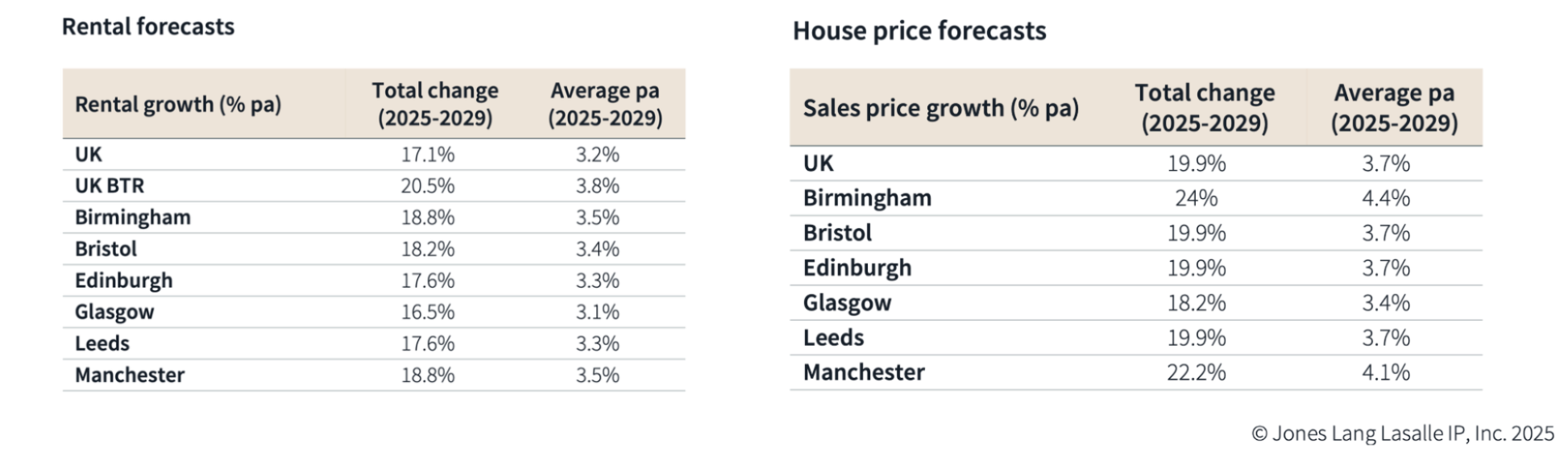

JLL forecasts:

3.5% UK house price growth in 2025, and

nearly 20% cumulative growth by 2029

Rents expected to grow even faster, driven by urban shortages and student/young professional demand

This is a market rewarding investors who play the long game.

For investors moving capital into GBP, the UK remains a long-term anchor rather than a fast flip – and Birmingham’s fundamentals make it one of the strongest anchors available.

What This Means for Investors

For clients and partners of On Invest, the conclusions are clear:

Birmingham should be on your shortlist – if not your top pick.Its performance is now data-backed, structural, and recognised by institutions.

Look beyond London.The real value, yield, and growth trajectory lies in regional powerhouses like Birmingham, Manchester, and Leeds.

Favour income-led strategies. With demand outpacing supply, BTR and high-yield units will outperform.

Think 2030, not 2025. In a stabilising market, disciplined, long-horizon investors will win.

Pair UK assets with regional holdings. Diversifying into Australia or Thailand can soften FX swings for Asia-based investors.

The UK market is entering a more mature, measured phase – and in this environment, Birmingham has emerged as the city to watch. For investors across Asia, the opportunity lies not in chasing hype, but in understanding where demand is quietly compounding and where long-term value is being built from the ground up.

At On Invest, we help investors navigate these decisions with structure, clarity, and deep on-the-ground intelligence.

Thinking about adding a UK property to your cross-border portfolio?

Let’s talk about whether Birmingham – or one of the other rising regional cities – is the right move for you.