Why invest in London?

Investing in London property in 2025 offers a compelling opportunity, backed by strong market fundamentals, global appeal, and long-term growth potential.

1. Global Financial Hub with Economic Resilience

London remains a global city, boasting a GDP of £617.9 billion in 2023, accounting for approximately 22% of the UK's total GDP.

2. Strong Rental Demand and Yield Potential

The city's rental market is robust, driven by a growing population and a significant influx of international students, business investment and professionals. This demand supports steady rental yields, making buy-to-let investments particularly attractive. Rental yields vary depending on area, with higher yields in outer boroughs and steady demand across the city.

3. Limited Housing Supply Amid Growing Demand

London continues a housing shortage, with new home construction lagging behind population growth. This scarcity underpins long-term capital appreciation prospects, with home prices expected to grow by 3.0% in 2025 and 4.0% in 2026.

4. Attractive to International Investors

London remains a key destination for international property investors, particularly from the US and the Middle East, drawn by the city’s global prestige, legal stability, and favourable exchange rates. However, recent UK tax reforms — including the planned abolition of non-domiciled status and changes to inheritance and CGT rules for overseas buyers — have prompted some high-net-worth individuals to reconsider their residency or shift investments elsewhere. Even so, demand for prime and new-build properties in central London remains resilient, as global investors continue to see long-term value in the capital’s real estate market.

5. Infrastructure Developments Enhancing Connectivity

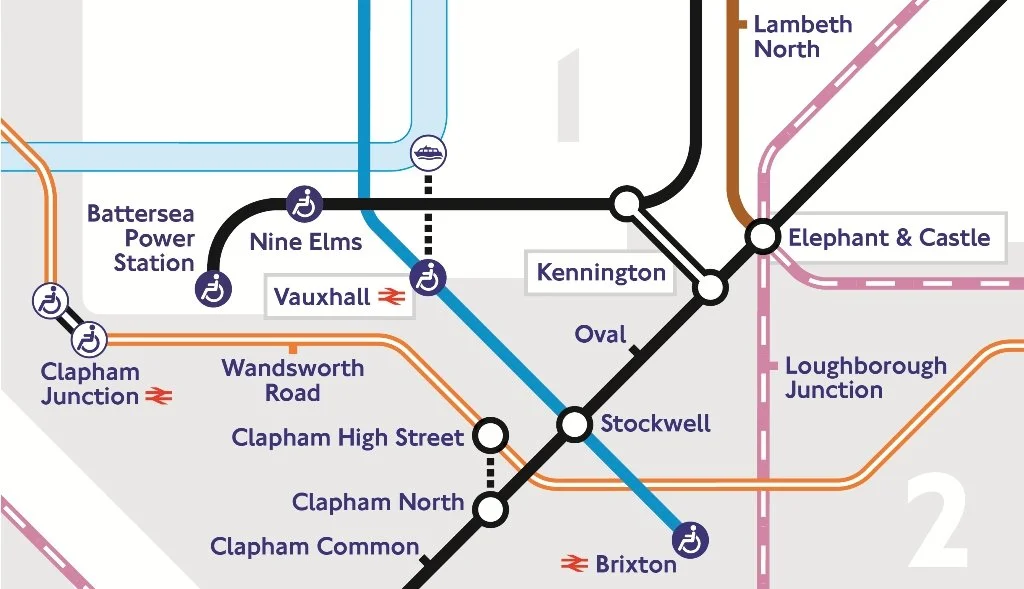

Major infrastructure projects, such as the Northern Line extension to Battersea, have improved connectivity and spurred regeneration in various areas, boosting property values.