What Savills’ revised UK house-price forecast means for you (2025–2029)

• Savills cuts 2025 UK house-price growth to about 1% but keeps around 24.5% cumulative growth by 2029 as affordability and lending ease.

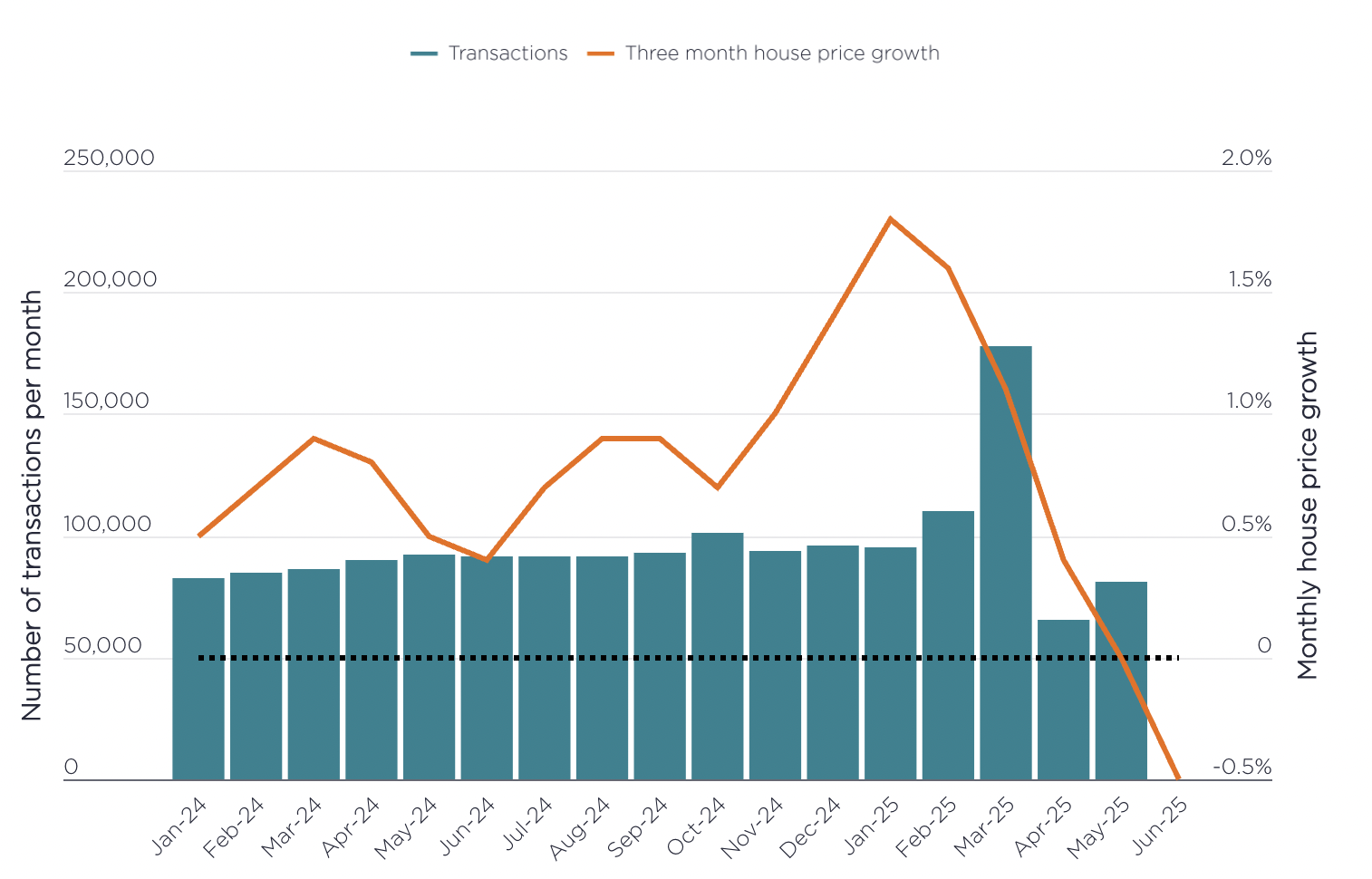

• Sales are expected to rebuild from 2026, trending toward around 1.2 million a year by 2027; near-term conditions remain choppy after the stamp-duty change.

• Monthly data are jumpy (June 2025 −0.8%; July 2025 +0.6%) – buy selectively and negotiate.

Courtesy of HMRC, Nationwide

The headline, explained

Savills’ July update isn’t calling a boom; it’s saying this year is a grind, the next few look better. After a stop-start first half, 2025 is now pegged at roughly 1% growth. Even so, Savills still sees about 24.5% cumulative growth by 2029 as mortgage costs ease and more buyers qualify again. In short: buy carefully in 2025 and negotiate; from 2026, activity should normalise and sales build.

Why 2025 feels messy (and how to use it)

Spring was distorted by tax timing. A rush to complete before changes pulled deals forward, then the market caught its breath.

The tape is whippy. Nationwide showed −0.9% in June and +0.6% in July – classic price-discovery. Don’t chase; negotiate.

Sellers are pragmatic. New-seller pricing has softened at the margin, which makes it a better time for buyers in the market.

How to buy well in 2025 (plain English)

Buy for quality, not headlines.

Go for “easy to let, easy to sell”: good transport, schools, sensible service charges, strong EPC, and no cladding issues. If a listing has sat 30+ days, start 2–5% under asking and let the survey do some work for you.Stress-test the mortgage.

Underwrite at +150–200 bps above today’s rate so any cuts become upside, not rescue.Own now, occupy later.

If you expect to move back, a well-located rental you’d happily live in later keeps options open while the five-year path plays out.Paperwork from Hong Kong.

Some UK lenders will work with non-resident income. Line up proof of funds, ID, and (if you have it) a UK correspondence address early to speed approvals.

Where the opportunities tend to cluster

FTB-type stock (two–three-bed houses or practical flats) in commuter belts and rail-linked areas – first to benefit when affordability improves.

Value pockets outside the South. Regional markets with deep tenant pools and regeneration on the way often lead when lending loosens.

Sensible new-builds with transparent charges and strong onsite management can suit “own-then-occupy” plans.

What to watch each month (so you don’t overthink noise)

Savills’ five-year track: the direction matters more than the exact number – still about 24.5% to 2029.

Nationwide monthly print: keep an eye on the MoM and affordability commentary (e.g., July +0.6% after June −0.9%).

Rightmove asking-price tone: a quick read on seller realism and whether new stock is sensibly priced.

-

Not if you buy well. Low headline growth often means more negotiation power. The prize is the multi-year upswing Savills still expects to 2029.

-

Often, yes — the reservation fee is typically £1,500–£3,000 (≈ HKD 15,000–30,000). That holds a unit for ~14–28 days while you sort documents and your mortgage in principle. Important: after reservation you’ll usually exchange contracts with a 10% deposit (less the reservation fee) and, on some schemes, pay small staged deposits during construction. The mortgage is drawn at completion. So the HKD ~20,000 gets you in the door, but you must plan for the deposit timetable below.

-

Price first, mortgage second. If the deal is right on price/quality, fix modestly and refinance later if costs fall.